Coffee statistics in the Philippines have revolutionized the beverage industry much like fintech did to the financial sector, morphing it into a multi-billion peso stronghold that experiences incredible year-on-year growth.

Projections indicate that the coffee sector, which includes the cultivation, production, and coffee shop businesses, may surpass PHP 200 billion by the end of this decade.

Contents

ToggleHow big is the coffee market in the Philippines?

As of 2023, the Philippine coffee market is valued at USD 1.62 billion, with a projected CAGR of 5.9% from 2023 to 2028.

What percentage of Filipinos drink coffee?

About 90% of Filipino adults consume coffee daily. Coffee drinking is embedded in Filipino culture, often enjoyed during breakfast or social gatherings.

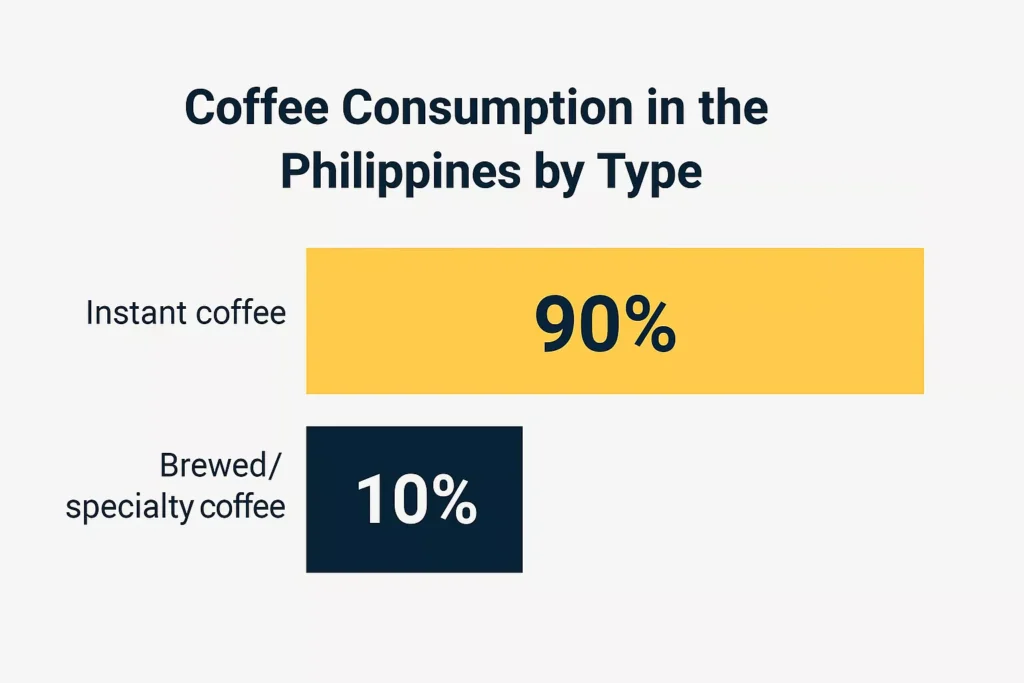

What type of coffee do Filipinos consume the most?

Instant coffee remains the most popular type, capturing nearly 90% of market share. Convenience and affordability are key reasons behind its widespread use.

How much coffee does the Philippines consume annually?

The Philippines consumes more than 100,000 metric tons of coffee annually. Local production cannot meet demand, so over 70% of coffee is imported.

Is the Philippines a coffee-producing country?

Yes. The Philippines produces four varieties of coffee: Arabica, Robusta, Excelsa, and Liberica. Despite this, local production accounts for only 30% of national consumption.

What is the main challenge in the Philippine coffee industry?

The biggest challenge is low productivity on farms. Factors include aging farmers, limited access to modern equipment, and strong foreign brand competition.

How do MSMEs perform in the coffee manufacturing sector?

MSMEs in coffee manufacturing reported performance better than target in return on assets (ROA), profit margin, sales growth, and market share. However, they operate under high competitive pressure.

What factors affect coffee MSME performance?

Based on Porter’s Five Forces framework, key factors are:

- Competitive rivalry: Very high

- Bargaining power of suppliers and buyers: High

- Threat of new entrants and substitutes: High

These forces significantly affect MSMEs’ financial performance.

What is the forecast for the coffee industry in the Philippines?

The government aims to achieve 100% self-sufficiency by 2040. Current efforts focus on improving local production through training, mechanization, and investment partnerships.

Are there opportunities in the Philippine coffee market?

Yes. Growth areas include:

- Specialty coffee shops

- Ready-to-drink (RTD) products

- Sustainable sourcing

- Local bean promotion

Rising coffee consumption and urbanization create more room for innovation and entrepreneurship.

Coffee Industry Philippines Statistics

The Philippines is the 14th largest coffee producer in the world, contributing significantly to the global coffee industry. (Source: The Philippine Coffee Industry Roadmap 2021-2025)

The coffee industry in the Philippines is expected to grow at a CAGR of 3.5% from 2021 to 2025. (Source: The Philippine Coffee Industry Roadmap 2021-2025)

The Philippines coffee industry is dominated by four primary species: Arabica, Robusta, Excelsa, and Liberica. (Source: The Philippine Coffee Industry Roadmap 2017-2022)

Robusta accounts for 69% of the total coffee production in the country. (Source: The Philippine Coffee Industry Roadmap 2021-2025)

The Philippine coffee industry predominantly comprises smallholder farmers, with 95% of farms measuring less than 5 hectares. (Source: The Philippine Coffee Industry Roadmap 2017-2022)

The country’s coffee industry faces a significant gap between production and consumption, with a deficit of 37,000 MT in 2017. (Source: The Philippine Coffee Industry Roadmap 2017-2022)

The Philippines government has developed the Philippine Coffee Industry Roadmap 2017-2022 to boost the sector’s growth. (Source: The Philippine Coffee Industry Roadmap 2017-2022)

The coffee industry in the Philippines is characterized by very high competitive rivalry. (Source: Industry Characteristics and Performance of Philippine Coffee Manufacturing Firms: MSMEs Perspective)

The threat of potential entrants in the Philippine coffee industry is high, indicating that new companies can quickly enter the market. (Source: Industry Characteristics and Performance of Philippine Coffee Manufacturing Firms: MSMEs Perspective)

For the first quarter of 2023, the production of coffee (green coffee beans) in the Philippines was estimated at 9.42 thousand metric tons, marking a 1.3 percent increase from the same quarter of 2022. (Source: Philippine Statistics Authority)

Robusta remains the country’s most-produced type of coffee, accounting for 73.5 percent of the total production during the first quarter of 2023. (Source: Philippine Statistics Authority)

SOCCSKSARGEN is the highest producer of coffee in the Philippines, contributing 33.4 percent of the country’s total coffee production for the first quarter of 2023. (Source: Philippine Statistics Authority)

Revenue in the Coffee market in the Philippines amounts to US$2.33bn in 2023. (Source: Statista Market Forecast)

The Coffee market in the Philippines is expected to grow annually by 8.22% (CAGR 2023-2028). (Source: Statista Market Forecast)

The volume in the Coffee market is expected to amount to 183.10m kg by 2028. (Source: Statista Market Forecast)

The average volume per person in the Coffee market is expected to amount to 1.25kg in 2023. (Source: Statista Market Forecast)

The revenue in the coffee segment is projected to reach US$4,439m in 2023. (Source: Statista)

The market is expected to grow annually by 12.1% (CAGR 2023-2025). (Source: Statista)

In relation to total population figures, per-person revenues of US$40.63 will be generated in 2023. (Source: Statista)

The average per capita consumption stands at 2.4 kg in 2023. (Source: Statista)

Arabica coffee, which shared 24.2% of total production, increased by 2.0%. [Source: Philippine Statistics Authority]

Production of Excelsa coffee, which accounted for 5.8% of the total output, rose by 1.1%. [Source: Philippine Statistics Authority]

However, Liberica coffee, which contributed 0.3% to the total production, declined by 1.6%. [Source: Philippine Statistics Authority]

The Philippines’ instant coffee market is estimated to grow at a CAGR of 12.29% to reach a market size of US$4,422.197 million in 2028 from US$1,964.402 million in 2021. [Source: Knowledge Sourcing]

The prime factor predicted to drive the growth of the Philippine instant coffee market is the growing trend of coffee consumption, in addition to the increasing production initiatives taken by the government in the country. [Source: Knowledge Sourcing]

The offline segment dominates the Philippines’ instant coffee market, owing to greater storage space and a wider selection among many products contributing to the demand for retail growth under the offline segment. [Source: Knowledge Sourcing]

Coffee Consumption Philippines Statistics

Filipinos consume an average of 2.4 cups of coffee per day. (Source: The Philippine Coffee Industry Roadmap 2017-2022)

The annual per capita consumption of coffee in the Philippines is estimated at 2.4 kg. (Source: The Philippine Coffee Industry Roadmap 2017-2022)

The total coffee consumption in the Philippines is projected to reach 166,000 MT by 2022. (Source: The Philippine Coffee Industry Roadmap 2017-2022)

The consumption of soluble coffee in the Philippines is expected to grow at a CAGR of 5.5% from 2021 to 2025. (Source: The Philippine Coffee Industry Roadmap 2021-2025)

The consumption of green coffee in the Philippines is expected to grow at a CAGR of 2.7% from 2021 to 2025. (Source: The Philippine Coffee Industry Roadmap 2021-2025)

The Philippines’ instant coffee market is projected to grow at a CAGR of 12.29% to reach a market size of US$4,422.197 million in 2028 from US$1,964.402 million in 2021. (Source: Philippines Instant Coffee Market Size: Industry Report, 2023 – 2028)

Filipinos are projected to spend an average of $44 per person on instant coffee in 2022. (Source: Coffee Affection)

Filipinos are expected to consume 3.78 kilograms of coffee per person by 2025. (Source: Coffee Affection)

Before the Covid pandemic, Filipinos consumed 3.4 kilograms of coffee per person per annum. (Source: Coffee Affection)

The Philippines is the second-largest consumer of coffee in Asia. (Source: Coffee Affection)

90% of households in the Philippines have coffee in their cupboards. (Source: Coffee Affection)

93% of households buy some coffee every week. (Source: Coffee Affection)

Filipinos are now considered heavy coffee drinkers. (Source: Coffee Affection)

Coffee Shop Philippines Statistics

The number of coffee shops in the Philippines has been growing steadily, with a 3% increase in outlets in 2017. (Source: The Philippine Coffee Industry Roadmap 2017-2022)

The coffee shop industry in the Philippines is dominated by international chains, with local chains and independent outlets also making a significant contribution. (Source: The Philippine Coffee Industry Roadmap 2017-2022)

The coffee shop industry in the Philippines is expected to grow at a CAGR of 7.1% from 2021 to 2025. (Source: The Philippine Coffee Industry Roadmap 2021-2025)

The average spend per visit to a coffee shop in the Philippines is PHP 300. (Source: The Philippine Coffee Industry Roadmap 2017-2022)

The coffee shop industry in the Philippines is characterized by high competitive rivalry, with a large number of international and local players. (Source: Industry Characteristics and Performance of Philippine Coffee Manufacturing Firms: MSMEs Perspective)

The coffee shop industry in the Philippines has seen a significant increase in the number of local coffee shops, contributing to the industry’s overall growth. (Source: Coffee Shops in the Philippines: Statistics)

Coffee retail brands such as UCC, Starbucks, and Coffee Bean & Tea Leaf have established a strong presence nationwide, providing further incentives for the industry to develop. (Source: Philippines Instant Coffee Market Size: Industry Report, 2023 – 2028)

Starbucks is, by far, the biggest coffee shop chain in the Philippines. (Source: Coffee Affection)

The average cost of a cup of coffee in a coffee shop in the Philippines is $3.02. (Source: Coffee Affection)

The Philippines has seen a significant increase in coffee shops, with a growth rate of 12.7% in 2021. This growth is attributed to the increasing coffee culture in the country and the expansion of international coffee chains like Starbucks and The Coffee Bean & Tea Leaf. Coffee Shops in the Philippines Statistics

Coffee Drinkers Philippines Statistics

Approximately 90% of Filipino adults consume coffee regularly. (Source: The Philippine Coffee Industry Roadmap)

The average age of coffee drinkers in the Philippines is 24-35 years old. (Source: The Philippine Coffee Industry Roadmap 2017-2022)

Approximately 60% of coffee drinkers in the Philippines prefer instant coffee due to its convenience and affordability. (Source: The Philippine Coffee Industry Roadmap 2017-2022)

About 40% of coffee drinkers in the Philippines prefer brewed or specialty coffee. (Source: The Philippine Coffee Industry Roadmap 2017-2022)

The preference for specialty coffee among Filipino coffee drinkers is growing, with a 10% increase in consumption in 2017. (Source: The Philippine Coffee Industry Roadmap 2017-2022)

The growing trend of coffee consumption in the Philippines is a significant driver for the growth of the instant coffee market. (Source: Philippines Instant Coffee Market Size: Industry Report, 2023 – 2028)

The Department of Agriculture (DA) announced a collaboration with Nestlé Philippines in October 2022 to scale up the coffee business, focusing on expanding local production and enhancing the country’s sufficiency level, which is presently at 15%. (Source: Philippines Instant Coffee Market Size: Industry Report, 2023 – 2028)

According to the Philippine Council for Agriculture and Fisheries, Robusta is the most farmed coffee variety in the nation, accounting for 76.5% of total output in 2020. (Source: Philippines Instant Coffee Market Size: Industry Report, 2023 – 2028)

Nestle Philippines, Inc. is the largest local manufacturer of soluble coffee, accounting for 80% of the instant coffee market. (Source: Philippines Instant Coffee Market Size: Industry Report, 2023 – 2028)

90% of households in the Philippines have coffee in their cupboards. (Source: Coffee Affection)

80% of Filipino adults drink an average of 2.5 cups of coffee daily. (Source: Coffee Affection)

93% of households in the Philippines buy some coffee every week. (Source: Coffee Affection)

Filipinos are now considered heavy coffee drinkers. (Source: Coffee Affection)

How to Venture Into This Coffee Shop Industry

Whether you’re already in the coffee business or looking to venture into this dynamic industry, understanding the comprehensive coffee statistics in the Philippines is crucial. The coffee industry here shows no signs of slowing down, presenting vast opportunities with billions of pesos invested annually and a significant percentage of the population indulging in coffee daily. You certainly want your business to stay caught up in this thriving landscape.

When people look for their next coffee shop visit or a brand to bring home, they often turn to search engines for information. As the potential franchise owner of a coffee shop, you should ensure your business is among the first to show up when customers start their online search.

Hills and Valleys Coffee has the expertise to help your coffee shop business gain visibility and thrive in the Philippines. Our franchise offers a turnkey solution covering everything from location selection, setup, and marketing, ensuring your business is ready to brew success.

To learn more about how Hills and Valleys Coffee Co. can help you become a part of the flourishing coffee industry in the Philippines, check out our coffee shop franchise. Or reach out to us today for a detailed discussion. Let’s brew success together in the land of coffee lovers.Coffee Industry Statistics Philippines 2023: Discover key trends, growth projections, and consumption patterns in the Filipino coffee market.

Venchito Tampon

Venchito Tampon is the Founder and Chief Executive Officer of Hills and Valleys Cafe, known for its affordable yet high-quality coffee beverages. They currently have branches in San Jose Del Monte, Bulacan, Lower Bicutan Taguig and Davao City.